Callable or Redeemable Bond Types, Example, Pros & Cons

Whereas bonds recalled during the final stages of their tenure will come with lower call values. You are now leaving the SoFi website and entering a third-party website. SoFi has no control over the content, products or services offered nor the security or privacy of information transmitted to others via their website. We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. Suppose you buy a bond from Company XYZ that has a 10-year maturity date and pays a 6% annual coupon.

Disadvantages of callable bonds

Learn about the types of U.S. savings bonds, how to buy or redeem them, and calculate their value. Find out how to change a bond’s ownership, replace it, and whether it is taxable. As the name goes by, an extraordinary bond allows for extraordinary redemption. Companies can only redeem these bonds before the maturity date on the occurrence of particular events, like if an approved or funded project gets damaged or delayed. It’s easy to get started when you open an investment account with SoFi Invest.

Invest Right, Invest Now

If interest rates have declined after five years, ABC Corp. may call back the bonds and refinance its debt with new bonds with a lower coupon rate. In such a case, the investors will receive the bond’s face value but will lose future coupon payments. The largest market for callable bonds is that of issues from government sponsored entities. In the U.S., mortgages are usually fixed rate, and can be prepaid early without cost, in contrast to the norms in other countries. By issuing numerous callable bonds, they have a natural hedge, as they can then call their own issues and refinance at a lower rate. If market interest rates decline after a corporation floats a bond, the company can issue new debt, receiving a lower interest rate than the original callable bond.

Callable (or Redeemable) Bonds: Definition, Types, Examples, Working & Formula

Both Series EE and Series I bonds can be cashed in once they’re a year old. If you cash in either series sooner than five years, you’ll lose the last three months of interest payments. If you’re considering U.S. savings bonds as part of a personal savings plan, there are some important details to know about how the bonds work.

- This means the issuers have the option to refinance their debt later at a better interest rate, much like a homeowner might refinance their mortgage to have a lower monthly payment.

- The series of call dates is known as a call schedule, and for each of the call dates, a particular redemption value is specified.

- While the government issues U.S. savings bonds, corporate bonds are sold by companies looking to raise funds to build their capital.

- The other variable refers to the price of a standard vanilla bond, which is similar in structure to a callable bond.

- This flexibility is usually more favorable for the business than using bank-based lending.

How to cash in savings bonds

The call date that immediately follows the end of the call protection is called the first call date. The series of call dates is known as a call schedule and for each of the call dates, a particular redemption value is specified. An issuer may redeem its existing bonds on the call date if interest rates are favorable. If rates and yields rise enough, issuers will likely choose to not call their bonds until a later call date or simply wait until the maturity date to refinance. If interest rates drop, the issuer of a callable bond is likely to exercise the call option and issue new bonds at lower interest rates. Fixed-income investors will lose the steady stream of income and will likely need to put their money in a lower-yielding investment unless they’re willing to accept more risk.

Valuing callable bonds differs from valuing regular bonds because of the embedded call option. The call option negatively affects the price of a bond because investors lose future coupon payments if the call option is exercised by the issuer. Thus, the issuer has an option which it pays for by offering a higher coupon rate.

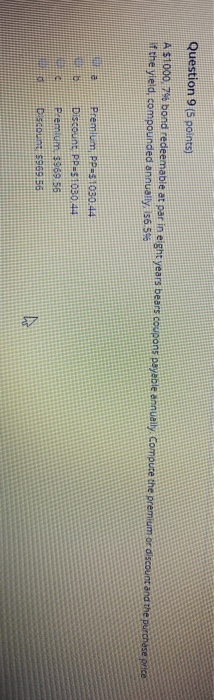

So when a mutual fund investor requests a redemption, the fund management company will issue the investor a check for the shares at market value. To compute the capital gain or loss on redemption, the investor must know the cost basis, which is the original value or purchase redeemable bond price of the asset. Bonds can be purchased at a price other than the par or face amount of the bond. Callable bonds are often called when interest rates fall significantly, making it financially beneficial for the issuer to refinance the debt at a lower cost.

A callable bond allows the issuing company to pay off their debt early. A business may choose to call their bond if market interest rates move lower, which will allow them to re-borrow at a more beneficial rate. Callable bonds thus compensate investors for that potentiality as they typically offer a more attractive interest rate or coupon rate due to their callable nature.

Some bonds have specific call provisions that allow the issuer to redeem the bond at specified dates prior to maturity at a stated price, which can be the same as or different from the bond’s face value. In addition, companies sometimes do tender offers to buy back bonds on the open market, and when that happens, selling bondholders have their bonds redeemed in exchange for the agreed-upon payment. To compensate callable security holders for the reinvestment risk they are exposed to and for depriving them of future interest income, issuers will pay a call premium.

These bonds allow issuing entities to pay off their debts earlier than the stipulated time. When the issuer calls the bond, it pays investors the call price or the face value of the bond, along with the accrued interest to date. Call protection refers to the period when the bond cannot be called. The issuer must clarify whether a bond is callable and the exact terms of the call option, including when the timeframe when the bond can be called. Optional redemption lets an issuer redeem its bonds according to the terms when the bond was issued.

It refers to a clause in callable bonds which prohibits issuers from redeeming these instruments prematurely for a particular time period. It indicates that issuers cannot buy back such bonds before completion of 5 years from date of issue. Callable securities are commonly found in the fixed-income markets and allow the issuer to protect itself from overpaying for debt, in the form of callable bonds. It’s important to keep in mind the pros and cons of investing in callable bonds when considering a long-term investing strategy. Some municipal bonds have a redeemable option 10 years after the issue of the bond was issued.